20 Business Deduction 2024 Amount

20 Business Deduction 2024 Amount – Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the .

20 Business Deduction 2024 Amount

Source : www.chegg.comThe Best Receipt Scanner Apps to Manage your Business Expenses in

Source : www.fylehq.comThe IRS recently announced Merline & Meacham, P.A. | Facebook

Source : m.facebook.comThe Livestock Conservancy on X: “https://t.co/NmxfMZLpoS” / X

Source : twitter.comMcDaniel & Associates, P.C. | Dothan AL

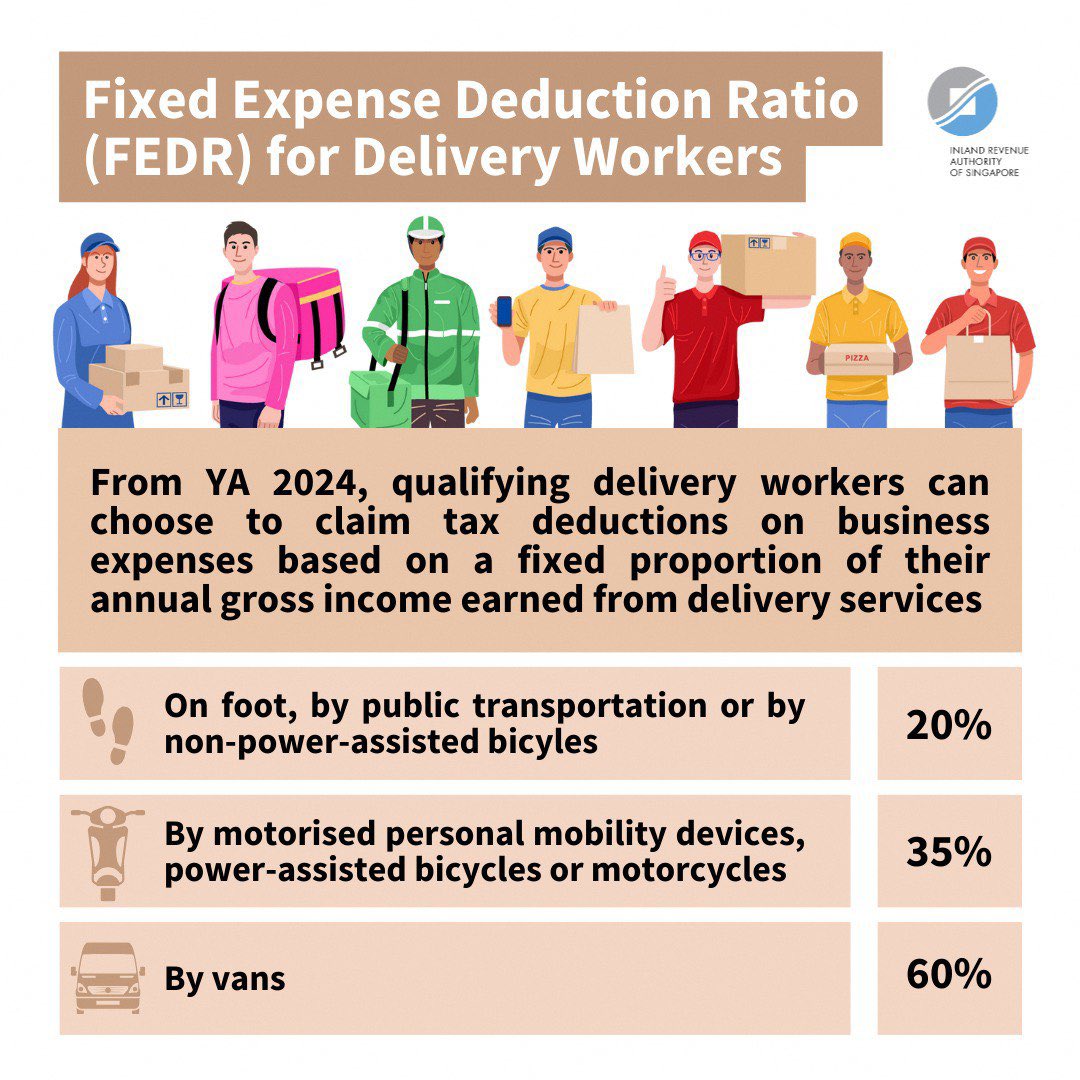

Source : m.facebook.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comZ5 Marketing

Source : m.facebook.comElections 2024: Focus on policy over politics | Columbia

Source : www.columbiathreadneedleus.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.orgPenn Township approves 2024 budget | Chester County Press

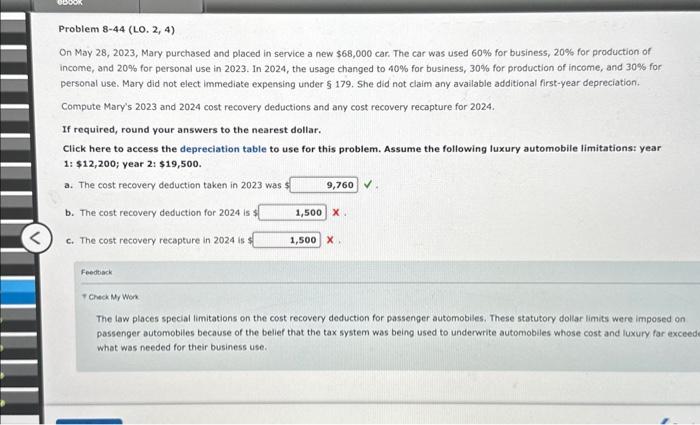

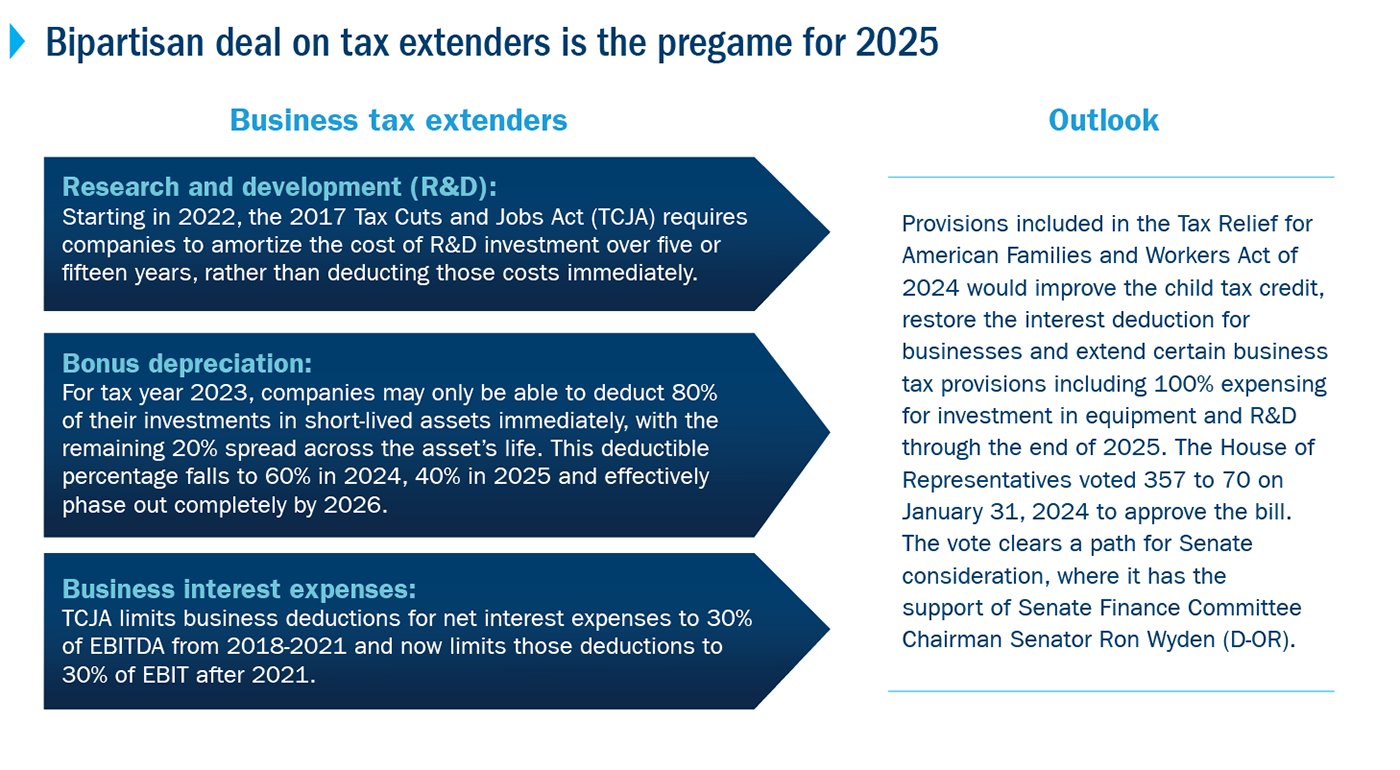

Source : www.chestercounty.com20 Business Deduction 2024 Amount Solved On May 28,2023 , Mary purchased and placed in service : According to the tax proposals in Finance Minister Enoch Godongwana’s Budget speech yesterday, the only things that will change for individuals in the 2024/25 tax year will be above-inflation . The TRAFW Act would increase the amount of business interest that a taxpayer can deduct for tax years and prior to January 1, 2024, is subject to 80% bonus depreciation, and bonus depreciation is .

]]>